Apple Inc, incorporated on January 3, 1977, is a multinational technology company that is listed on the Nasdaq stock exchange since December 1980. Based out of Cupertino, the market capitalization of Apple is $2.07 trillion. Apple's product profile includes iPhone, iPad, Mac, iPod, Apple Watch, Apple TV, while software portfolio comprises iPhone OS , OS X and watchOS operating systems, iCloud and Apple Pay. Apple is also into digital content streaming services -- Apple Music and Apple TV+.For the quarter ended 27 June 2020, Apple earned a revenue of $59.7 billion, an increase of 11 per cent from the year-ago quarter.

Other major markets for Apple include Europe, India, Middle East, Africa, China and Japan. International sales accounted for 60 percent of the quarter's revenue. Key institutional investors include Fidelity Management & Research Company, Vanguard Group, BlackRock and Berkshire Hathaway.Apple's stock was priced at $22 in its initial public offering on 12 December 1980.

If adjusted for stock splits, the share price was about $0.10.In the global smartphone market, Apple has a 14 per cent share while in the PC segment it is at the fourth spot worldwide with 6.7 per cent market share. Read MoreApple Inc, incorporated on January 3, 1977, is a multinational technology company that is listed on the Nasdaq stock exchange since December 1980. The second Apple stock split took place on 21 June 2000, and was also a two-for-one split.

Shortly afterwards though, in September 2000, share prices were halved as many technology companies experienced a rapid decline. This was around the time the dot-com bubble burst, where many companies went out of business and others decreased in value. Apple blamed lower-than-forecast sales, as well as a weaknesses in the education market.

While Apple was affected temporarily, the company's shares made a full recovery and went on to achieve new highs. Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets. It distributes third-party applications for its products through the App Store. The company also sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers.

Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California. Apple's financial performance, including its share price, relies heavily on the sales of its products. A high flier through much of its recent history, Apple stock hit new all-time highs toward the end of 2021, with a market capitalization approaching a record $3 trillion. It seems unlikely that Apple will complete another stock divide in the near future. Share prices are still climbing (they are currently trading at around $186), however shares were worth close to $700 before the last split in 2014.

Apple may consider another stock split if share prices continue to rise, but for now, this move probably wouldn't be in the best interests of the company. Apple's fourth and final stock split to date happened on 9 June 2014. This was the most significant of Apple's stock splits, with a seven-to-one ratio taking shares from close to $700 down to around $100. Apple wanted to make shares accessible to more investors, but it's also speculated that they set their sights on inclusion in the Dow Jones Industrial Average index. This index acts as a benchmark, with 30 stocks included from key economic sectors. As it's a price weighted average, Apple's stock price needed to be reduced before it was feasible for the company to be added.

It was announced that Apple would join the Dow Jones in March 2015 and it has been a part of the index since March 2019. Stock divides might not directly increase share prices, but they can often result in higher share prices further down the line. By making shares accessible to new investors, demand can increase, causing the share price to appreciate and the total market capitalisation to rise. Apple's first stock split occurred on 16 June 1987, seven years after it became a public company, and it was a two-for-one stock split. It kept share prices low enough to make them accessible to investors. There was a 2% rise in stock prices over the following year.

When looking at the value of a company's shares, it can be difficult to interpret how successful the company has been based on its stock prices following a split. Apple's current share price of around $408 doesn't look as impressive as it would have done ahead of its four stock splits. An investor buys a share in Apple in January 2005, so they have one share worth $77.00. After the two-for-one stock split a month later, they own two shares in Apple, but each of these shares is worth half the amount, at $38.50.

If the shareholder keeps these two stocks until May 2014, they will be worth $1,266 ($633 each) as the stock price appreciates. With the fourth stock split, each of these stocks will then be split seven times, so that the shareholder owns 14 shares in Apple. Gene Munster, a veteran Wall Street analyst who had rightly predicted Apple's run to $2 trillion market cap back in January 2020, believes that the Steve Jobs' company has a path to $3 trillion as well. Munster had covered Apple for a long time as an analyst at the investment bank Piper Jaffray.

He told CNBC recently that the iPhone maker can realistically reach $200 per share. This would push Apple's market cap beyond $3 trillion from the current $2.22 trillion market cap with its stock trading around $132 per share on Friday. Apple became the first publicly traded US firm to hit the $2 trillion market cap in August 2020. Shares in Apple have been on a tear for years, but they've performed particularly well in 2020, gaining by more than 50 percent, despite the disarray caused by COVID-19.

The company's stock has gained, on average, 3.5 percent every week since the beginning of June, reports The Wall Street Journal. And its share price jumped significantly after its most recent earnings report in July, where the company reported record sales and a total of $59.7 billion in revenue — up 11 percent compared to the same quarter last year. Apple briefly became the world's first $3 trillion company today based on market capitalization, which is the total value of all of the company's outstanding shares.

The milestone came after Apple's stock price rose over 40% in the last year. The impressive feat, which Apple achieved when its stock price reached the $182.86 mark during intraday trading, came just over 16 months after Apple be... Apple's stock has split several times since it first went public in December 1980. The first split came on June 16, 1987, on a two-for-one basis at a pre-split price of $79. The next split came on June 21, 2000, when share prices reached $111. On Feb. 28, 2005, Apple split its stock again when it hit $90.

The company split its stock again on a seven-to-one basis on June 9, 2014, when share prices reached $656. The final stock split came on Aug. 28, 2020, when it split on a four-to-one basis at a pre-split price of $499.23. Apple's third stock split took place on 28 February 2005, with the company once again allocating a two-for-one ratio.

This took the number of common shares authorised from 900 million to 1.8 billion, after shares almost quadrupled in value. While a stock split might be carried out to encourage investment, the split in itself doesn't affect the market capitalisation of a company. Existing shareholders will own more stocks, but each of those stocks is worth less, so there is no change to the total market value of the company. Apple stock rose by 0.9% in trading this morning, but closed down 2.1%, at $175.74 per share. Talk of the $3 trillion mark came as JPMorgan updated its target share price for the company from $180 to $210, citing improved expectations around demand for the iPhone 13.

Apple told suppliers earlier this month demand for the new phone had weakened, but iPhone sales in China were up by more than 6% in November compared to the previous year, boosting analysts' confidence in the stock. In a note, JPMorgan analysts wrote they believed Apple's stock was undervalued, and that the company's upcoming iPhone with 5G technology has the potential to convert more than 1 billion Android users. Stock splits remain relevant for companies that want to bring in a wider base of shareholders, especially ones who had been put off by the high share price.

Based on today's closing price, after the split Apple's shares would cost $106.26 apiece. Lowering the share price increases demand, especially among retail investors who want to own the stock, but couldn't afford to pay $400 for a single share. And this is how the existing shareholders benefit from the stock split.

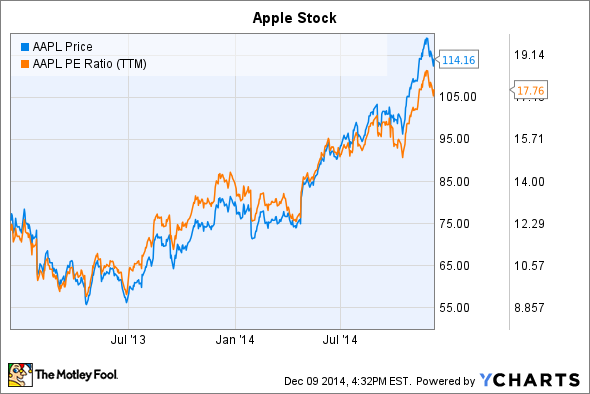

What's more important though, is that Apple's growth machine appears to be cooling down a little bit. In recent quarters, revenue growth decelerated significantly as Mac sales slump and competition in the smartphone and tablet markets is heating up. Perhaps even more worrying is the fact that Apple's gross margins have declined for four quarters in a row on a sequential basis. Many analysts are taking this as a sign that Apple's profits may have peaked and that the company's best days are behind it. If Apple's margins continue to decline, the company will need to reaccelerate revenue growth in order to keep profits where they are now, let alone increase them. The company has previously split its stock four times when its shares have seen significant price increases, as highlighted in the table below.

In the first three instances, stocks were split in two when the price was near triple figures. Then, in 2014, share prices rose sharply and a higher split ratio was used. While Apple didn't hit the $3 trillion market cap today, its share price remains 200% percent higher than it was prior to the pandemic. The company plans to release computerized glasses featuring augmented reality technology in 2022, and is developing a virtual reality headset as well.

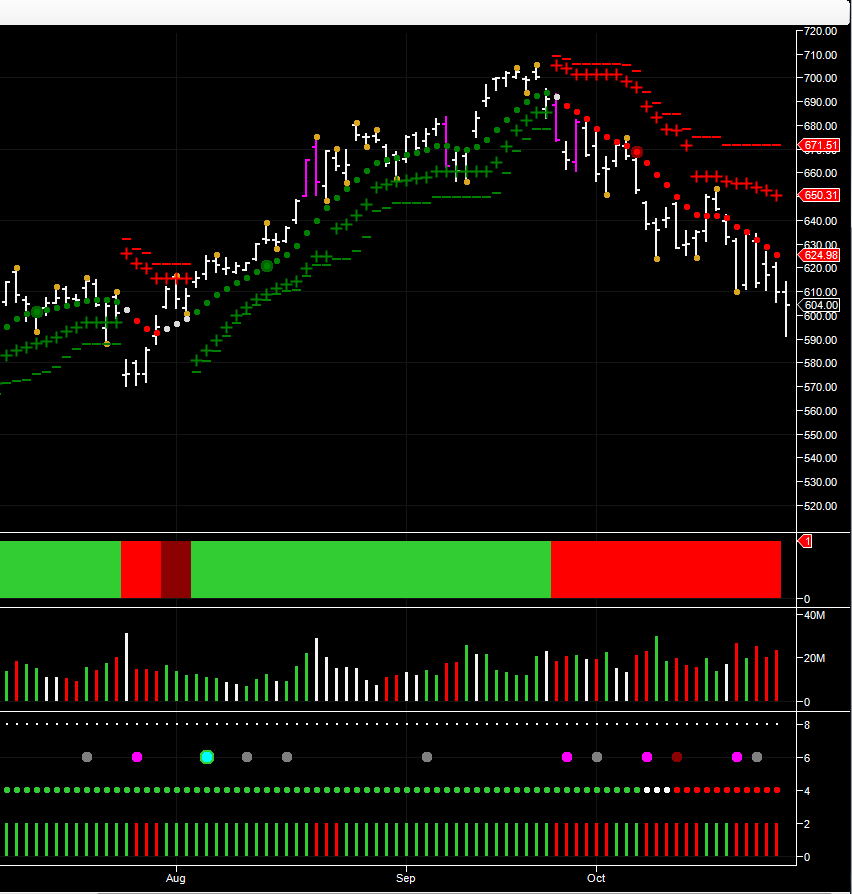

Apple is also working on a self-driving electric vehicle that could be on the market as soon as 2025. Stock buybacks reduce the number of total shares available for purchase. That makes each remaining share more valuable and improves the underlying fundamentals of the company in equations that large investors and automated trading systems use to pick stocks. Predictive indicators are helping investors to find signals for Apple stock's direction in advance. Even though most predictive indicators are useful for the short-term horizon, it's virtually impossible to predict the unforeseen stock market.

For traders with a short-term horizon, predictive indicators add value when properly applied. Long-term investors, however, may find many predictive indicators less useful. Apple Inc. designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. The Company's products include iPhone, Mac, iPad, and Wearables, Home and Accessories. IPhone is the Company's line of smartphones based on its iOS operating system. Mac is the Company's line of personal computers based on its macOS operating system.

IPad is the Company's line of multi-purpose tablets based on its iPadOS operating system. Wearables, Home and Accessories includes AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch and other Apple-branded and third-party accessories. AirPods are the Company's wireless headphones that interact with Siri. Its services include Advertising, AppleCare, Cloud Services, Digital Content and Payment Services. Its customers are primarily in the consumer, small and mid-sized business, education, enterprise and government markets.

When benchmark price declines in a down market, there may be an uptick in Apple Stock price where buyers come in believing the asset is cheap or selling overdone. You can use Apple intraday prices and daily technical indicators to check the level of noise trading in Apple Stock and then apply it to test your longer-term investment strategies against Apple. The iPhone giant announced after the market closed Thursday that its board approved a 4-for-1 stock split for every shareholder of record at the close of business on August 24. This means each Apple shareholder will receive three additional shares for every share held.

Shares will begin trading on a split-adjusted basis on Aug. 31. When Apple's stock briefly traded above $700 in September, some bullish analysts raised their target for the stock to $1,000. Four months and two disappointing earnings releases later, the tide has turned. Apple's stock price dropped 35 percent since September, shaving $250 billion off the company's market cap. We sell different types of products and services to both investment professionals and individual investors.

These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Moody's Daily Credit Risk Score is a 1-10 score of a company's credit risk, based on an analysis of the firm's balance sheet and inputs from the stock market. The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow. Updated daily, it takes into account day-to-day movements in market value compared to a company's liability structure. Apple's upcoming stock split will see investors issued with four new shares for every one they currently own. These shareholders will continue to own the same proportion of Apple stock, since the company will effectively increase the number of shares in circulation by dividing existing shares in four. We made this long, tedious joke about how Apple announcements don't move its share price for two reasons.

First, investors obviously have no idea what any of the company's announcements mean. And, second, because that fact mocks fans of the efficient market theory. Investors big and small now have loads more information than they did, and, in their view, Apple's shares are worth precisely what they were before. Mr. Lazonick said that buybacks increase stock prices by encouraging investors to buy, and then causing momentum in the stock market as other investors look to cash in on the increase. When Apple unveiled the iPhone in January 2007, the company was worth $73.4 billion.

Fifteen years later, the iPhone, already one of history's best-selling products, continues to post impressive growth. In the year ending in September, iPhone sales were $192 billion, up almost 40 percent from the year prior. Or is there an opportunity to expand the business' product line in the future? If investors know Apple will grow in the future, the company's valuation will be higher.

The financial industry is built on trying to define current growth potential and future valuation accurately. All the valuation information about Apple listed above have to be considered, but the key to understanding future value is determining which factors weigh more heavily than others. A focus of Apple technical analysis is to determine if market prices reflect all relevant information impacting that market. A technical analyst looks at the history of Apple trading pattern rather than external drivers such as economic, fundamental, or social events.

It is believed that price action tends to repeat itself due to investors' collective, patterned behavior. Hence technical analysis focuses on identifiable price trends and conditions. The simplest method is using a basic Apple candlestick price chart, which shows Apple price history and the buying and selling dynamics of a specified period. Many traders also use subjective judgment to their trading calls, avoiding the need to trade based on technical analysis. With $33 billion in cash on the balance sheet, in addition to the stock split, the board of directors declared a cash dividend of $0.82 per share of the company's common stock. The dividend is payable on August 13 to shareholders of record as of the close of business on August 10.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.